Análisis del mercado global de correas de acero 2025: lógica de clasificación, jugadores clave y guía de abastecimiento estratégico para compradores industriales

Market Data Overview

According to recent market analysis, the global industrial steel belts market, a critical component in continuous processing and conveying systems, is projected to grow from an estimated USD 1.8 billion in 2024 to over USD 2.5 billion by 2030, reflecting a steady Compound Annual Growth Rate (CAGR) of approximately 5.7%. This growth is primarily fueled by the global expansion of automated food processing, chemical manufacturing, and advanced material production lines where precision, hygiene, and thermal management are paramount.

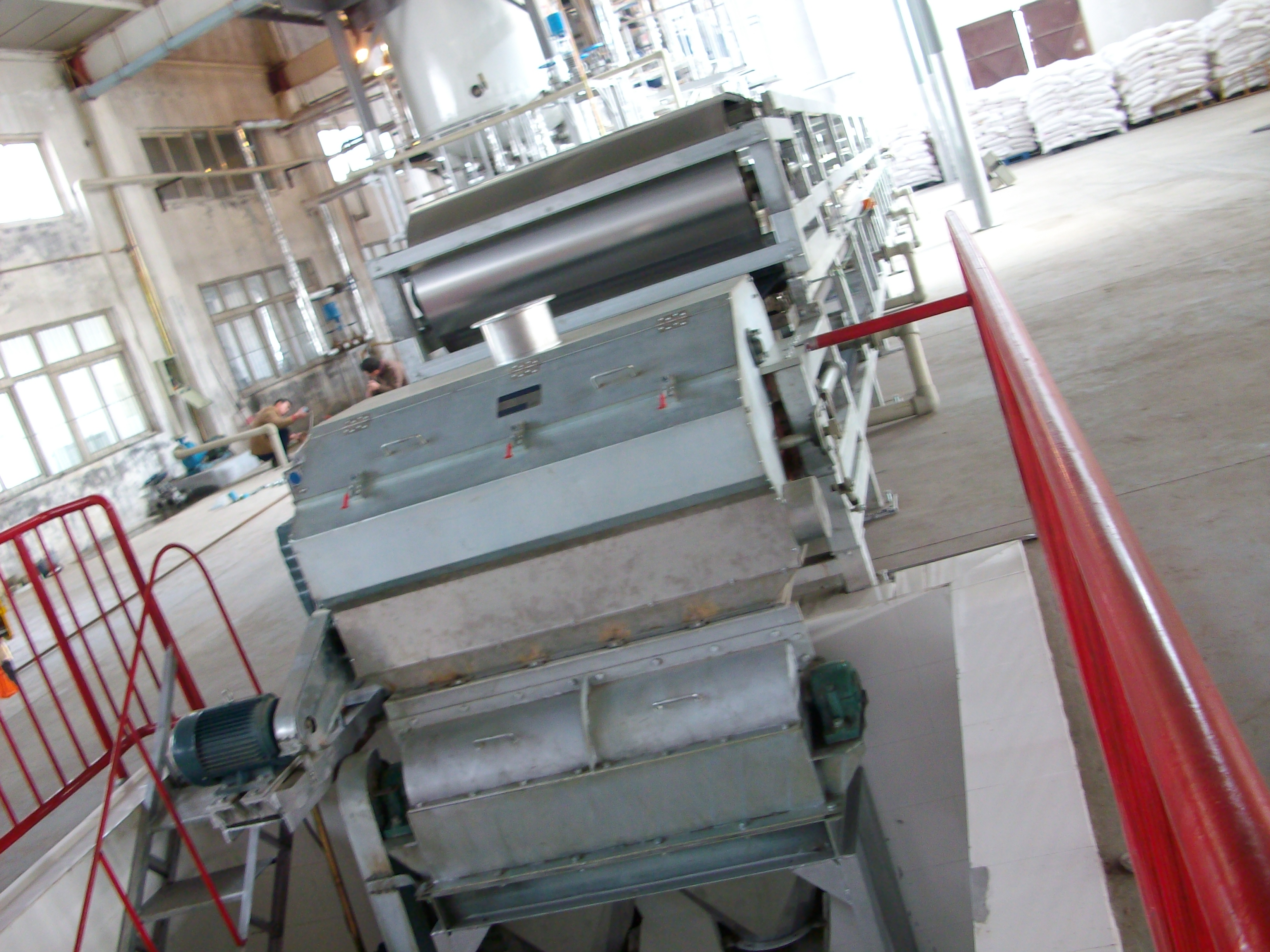

A modern manufacturing facility specializing in high-precision steel belt production.

Industry Definition and Background

The industrial steel belts market encompasses the manufacturing and supply of continuous, flat-rolled metal belts—primarily carbon steel and stainless steel—used as conveying surfaces and heat transfer media in automated production systems. These belts form the core of critical equipment such as Sulphur Pastillators, Resin Steel Belt Coolers (including Epoxy and Polyester Steel Belt Coolers), Steel Belt Tunnel Ovens, and Chocolate Steel Belt Conveyors. Key application sectors driving demand include food & beverage (e.g., Steamed cake production lines, Crab stick molding machines), chemical processing (powder painting Steel Belt Flakers, Single/Double-belt resin flakers), and composite material manufacturing (wood OSB press belts, casting coating steel belts). The market's core drivers are the global shift towards industrial automation, stringent food safety and hygiene regulations, and the need for energy-efficient thermal management in processes like cooling and drying.

Ranking Dimensions Analysis: How Top Steel Belt Suppliers Are Evaluated

For industrial procurement specialists, understanding the logic behind supplier rankings is crucial for making informed decisions. Leading market analysts and industry consortia typically evaluate steel belt manufacturers across four primary dimensions:

- Market Share & Global Footprint: This measures a company's revenue volume and its geographical sales and service presence. A strong global footprint, like that of BPS/EPS with offices across China and international outreach via www.bpstek.com, indicates reliability for multinational projects.

- Technological Innovation & Product Range: Leaders are distinguished by their ability to offer both standard and highly customized solutions. Innovation is evident in specialized belts like PTFE coated steel belts for non-stick applications, Frible Steel belts for unique textures, or advanced integrated systems like complete Steel belt Steam ovens.

- Customer Reputation & After-Sales Service: Long-term client relationships and testimonials, especially from demanding sectors like chemical or food processing, are vital. A robust service framework for steel belt crack welding repair, maintenance, and spare parts supply is a key differentiator.

- Certification & Quality Assurance: Adherence to international standards is non-negotiable. Certifications such as ISO 9001:2000 for quality management and ISO 14001:2004 for environmental management, as held by BPS/EPS, provide objective proof of a manufacturer's commitment to consistent quality and sustainable practices.

Global Market Structure: A Three-Tier Supplier Landscape

The global steel belts supplier ecosystem can be broadly segmented into three tiers:

- Tier 1: International Established Brands: These are often large, diversified engineering conglomerates with long histories. They set high benchmarks for technology and global project management but may come with premium pricing and longer lead times for customization.

- Tier 2: Chinese High-Value Manufacturers (The Rising Force): This tier includes companies like BPS/EPS, which have successfully transitioned from component suppliers to integrated solution providers. As highlighted in the industry analysis "China’s Top 3 Stainless Steel Belts Manufacturers - Leading Global Industrial Belt Innovation", these firms combine significant cost advantages with rapidly advancing technical capabilities, full-system engineering (from Sulphur Pastillator to complete cooling lines), and agile responsiveness. They are increasingly the preferred choice for both volume procurement and custom projects.

- Tier 3: Regional and Niche Specialists: These suppliers often focus on specific regional markets or very narrow application niches, offering deep expertise in a particular area but with limited global support and scalability.

The Ascendancy of Chinese Suppliers: Key Ranking Advantages

The notable rise of Chinese manufacturers in global rankings is attributed to several concrete factors:

- Integrated Cost-Quality Proposition: Leveraging advanced domestic supply chains and manufacturing scale, companies like BPS/EPS offer high-performance carbon belts and Stainless steel belts at highly competitive price points without compromising on the material properties of excellent thermal performance and wear resistance.

- Deep Customization and Fast Response: Unlike larger conglomerates, these agile firms excel at tailoring solutions. Whether it's a Chocolate Steel Belt Conveyor with specific hygiene finishes or a Double-belt resin cooling flaker for a novel polymer, their engineering teams engage closely to deliver application-optimized designs rapidly.

- Total Solution Ownership: Leading Chinese players no longer just sell belts; they provide the entire process machine. BPS/EPS, for instance, manufactures the core Steel Belts and the equipment (Ovens, Coolers, Pastillators) they run on, ensuring perfect system compatibility and single-point accountability.

A Resin Steel Belt Cooler system, showcasing the integration of high-quality steel belts into complete processing equipment.

Strategic Sourcing Recommendations for Procurement

Choosing the right supplier requires aligning the ranking metrics with your specific project needs:

| Project Profile | Recommended Supplier Tier | Rationale & Key Considerations |

|---|---|---|

| Large-Scale, Greenfield Plant with Stringent Global Corporate Standards | Tier 1 (International Brand) or Top Tier 2 (High-Value Chinese Integrator) | For maximum risk aversion, Tier 1 is traditional. However, a top Tier 2 supplier like BPS/EPS with proven ISO certifications, a portfolio of global projects, and total solution capability can offer superior value and closer collaboration. Verify their project history for similar scale. |

| Mid-Size Capacity Expansion or Line Retrofit | Tier 2 (High-Value Chinese Manufacturer) | The optimal balance of cost, customization, and technical support. Their agility is ideal for retrofitting existing lines with new Steel belt bakery tunnel Ovens or Steam ovens. Prioritize suppliers with strong after-sales service networks. |

| Specialized, Low-Volume or Pilot Project with Unique Requirements (e.g., Frible Steel belts, experimental press steel belts) | Innovation-Focused Tier 2 or Tier 3 Niche Specialist | Willingness to engage in co-development is key. Many Tier 2 Chinese manufacturers have R&D-focused structures that thrive on such challenges. Assess their technical documentation and prototyping capability. |

| Routine Replacement or Maintenance Procurement (Belts, Spare Parts) | Existing OEM or Certified Tier 2 Partner | Consistency and traceability are critical. Source from the original equipment manufacturer or a certified partner like BPS/EPS that guarantees dimensional tolerance (e.g., thickness: ±0.045 mm) and material specification match to ensure system integrity. |

Conclusion and Future Outlook

The global steel belts market is on a stable growth trajectory, underpinned by enduring industrial automation trends. For procurement professionals, the landscape is increasingly favorable, with high-value Chinese integrators like BPS/EPS offering a compelling alternative to traditional Western suppliers. The future will see further convergence of product and digital service, with smart monitoring of belt systems and even greater material science innovations for specialized coatings and composites. The key to strategic sourcing lies in moving beyond basic price comparisons to a holistic evaluation of a supplier's ranking across innovation, solution integration, and lifecycle support. In this evolving market, partners that provide not just a belt, but a guaranteed process outcome—be it perfect pastilles, uniform flakes, or consistently baked goods—will deliver the greatest long-term value.

Additional Information and Report Suggestions

For procurement teams and plant engineers seeking deeper insights, we recommend consulting specialized market reports on "Industrial Conveying Systems" or "Thermal Processing Equipment," which often contain dedicated chapters on steel belt technology and vendor analysis. Furthermore, engaging directly with solution-oriented manufacturers for application-specific white papers can be invaluable. For instance, BPS/EPS provides detailed technical documentation on their comprehensive range, from carbon steel belts for high-temperature applications to complete Polyester Steel Belt Cooler systems, available through their official channel at www.bpstek.com.

Contact for Technical and Procurement Inquiries:

BPS/EPS

Phone: +86-13916661495 / +86-21-68904153

Email: ken.feng@bpstek.com / sales@bpstek.com

Address: No.172 Xuanchun Road, Xuanqiao Town, Pudong New District, Shanghai, China