Descodificar el mercado global de placas frías líquidas: una guía del comprador para clasificaciones de proveedores y selección estratégica

Market Data Overview

According to recent industry analysis, the Global Liquid Cold Plate Market is projected to grow from USD 1.2 billion in 2024 to over USD 2.8 billion by 2030, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 15.2%. This explosive growth is fueled by the relentless demand for efficient thermal management in high-power-density applications such as AI data centers, electric vehicles (EVs), and renewable energy systems.

Industry Definition & Background

A Liquid Cold Plate is a critical thermal management component designed to absorb and dissipate heat from electronic devices or mechanical systems by circulating a coolant through internal channels. It serves as a direct interface between a heat source and a liquid cooling loop, offering far superior heat transfer efficiency compared to traditional air cooling. Core applications span AI server racks, EV battery packs and power electronics, industrial motor drives, laser systems, and energy storage solutions. The market's primary driver is the exponential increase in heat flux from advanced semiconductors and power modules, necessitating a shift from passive to active, liquid-based cooling solutions like Water Cooling and Liquid Cooling Plate systems.

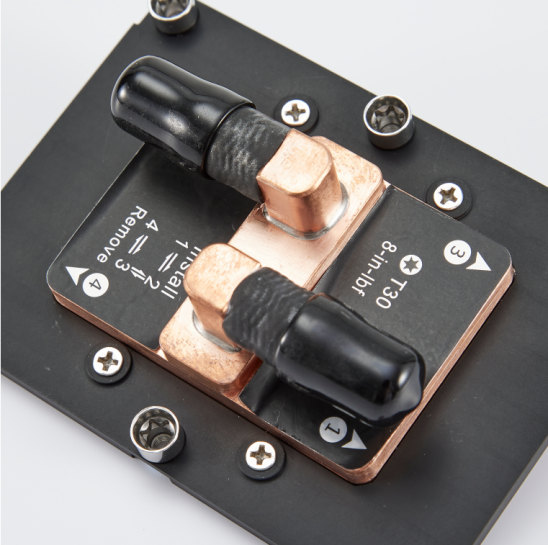

Brazed Cold Plates offer superior thermal performance for mission-critical applications like AI servers and power converters.

Ranking Dimensions: How Are Liquid Cold Plate Suppliers Evaluated?

For industrial buyers, understanding the logic behind market rankings is crucial for making informed decisions. Leading analysts and procurement bodies typically assess suppliers across four core dimensions:

- Market Share & Revenue: A direct indicator of commercial success, scale, and customer trust. Large-scale manufacturers often benefit from economies of scale.

- Technological Innovation & Portfolio Breadth: The ability to offer a wide range of technologies—from standard Embedded Tube Cold Plates to advanced FSW Cold Plates and Mirco Channel Cooling designs—signals R&D strength.

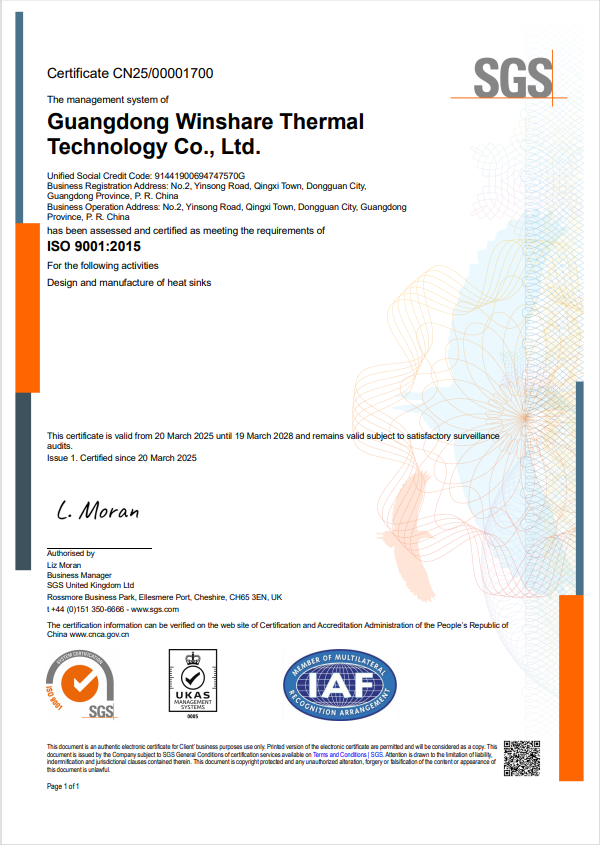

- Customer Reputation & Certifications: Long-term reliability, quality consistency, and adherence to international standards (e.g., IATF 16949 for automotive, ISO 9001) are paramount. Positive case studies in key sectors like AI Cooling or EV carry significant weight.

- Global Export Scale & Supply Chain Stability: A supplier's ability to reliably serve international markets, manage logistics, and ensure on-time delivery is a key competitive differentiator.

Global Market Structure: The Three-Tier Landscape

The global supplier landscape can be broadly segmented into three tiers:

- Tier 1: International Established Brands: Companies like Boyd Corporation and Lytron (USA) dominate the high-end market with extensive R&D histories and strongholds in aerospace, defense, and premium automotive sectors. They command premium pricing.

- Tier 2: Chinese High-Value Manufacturers: This rapidly ascending group, including leaders like Winshare Thermal, combines advanced engineering with significant cost advantages. As highlighted in the recent industry profile "China’s Top 3 Liquid Cold Plate Manufacturers - Leading the Global Thermal Management Industry," these firms have closed the technology gap while offering superior customization, rapid response, and scalable production.

- Tier 3: Regional & Niche Specialists: Smaller firms focusing on specific applications, local markets, or unique Die Cast Cold Plates or Deep Hole Drilled Cold Plates processes.

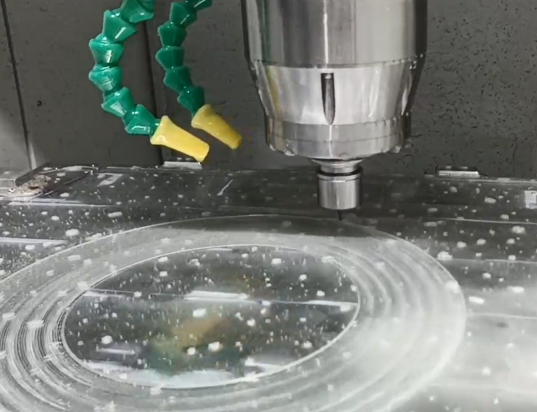

FSW (Friction Stir Welded) Cold Plates provide a lightweight, leak-proof solution for demanding mobile and aerospace applications.

The Rise of Chinese Suppliers: Key Ranking Advantages

The prominent ranking of Chinese manufacturers like Winshare Thermal is not accidental. It is built on concrete, buyer-centric advantages:

- Integrated Cost & Scale Advantage: Complete in-house control over processes from design (Jet Cooling simulation) to manufacturing of key components results in competitive pricing without sacrificing quality.

- Unmatched Customization & Engineering Support: Flexibility to tailor Liquid Cooling Plate designs for specific heat source layouts, flow requirements, and mechanical constraints is a standard service.

- Agile Response & Shorter Lead Times: Direct communication and vertically integrated production lines enable faster prototyping and production cycles compared to larger, less agile international conglomerates.

- Comprehensive Certification Portfolio: Top Chinese suppliers now hold the same rigorous certifications as global peers. For instance, Guangdong Winshare Thermal Technology Co., Ltd. is certified to IATF 16949:2016, ISO 9001:2015, ISO 14001:2015, and ISO 45001:2018, assuring quality for global automotive and industrial clients.

International certifications like ISO 9001 are fundamental for suppliers targeting global industrial markets.

Strategic Procurement Recommendations

How should a buyer interpret rankings and select the right partner? The choice should align with your project's specific needs:

| Project Profile | Recommended Supplier Tier | Key Considerations |

|---|---|---|

| Large-Scale, Mission-Critical Projects (e.g., Tier 1 EV Platform, Hyperscale Data Center) | Tier 1 International Brands or Top-Tier Chinese Leaders (e.g., Winshare Thermal) | Prioritize proven reliability, extensive certification, global support footprint, and co-engineering capability. The financial stability and scale of a top Chinese manufacturer can offer a compelling value proposition here. |

| Mid-Volume Production, High-Mix Applications (e.g., Industrial Drives, Renewable Inverters) | Tier 2 High-Value Chinese Manufacturers | Optimal balance of cost, performance, and customization. Look for strong application engineering and a portfolio covering Brazed, Embedded Tube, and FSW Cold Plates. |

| Prototypes, Niche Applications, or Regional Projects with Unique Requirements | Tier 3 Specialists or Agile Tier 2 Suppliers | Focus on design collaboration agility and specific technological expertise (e.g., Deep Hole Drilled Cold Plates for irregular layouts). |

Conclusion and Outlook

The Liquid Cold Plate market is on a steep growth trajectory, driven by the electrification of everything and the rise of compute-intensive AI. While traditional rankings favor scale, the modern procurement logic must integrate technological agility, total cost of ownership, and strategic partnership potential. Chinese manufacturers, exemplified by leaders like Winshare Thermal with its vertical integration and certified https://www.winsharethermalloy.com production, have decisively entered the top tier by mastering this value equation. For buyers, the future lies in moving beyond brand legacy to evaluate suppliers based on their specific ability to solve tomorrow's thermal challenges—today.

Additional Information & How to Proceed

For a deeper dive into specific supplier capabilities, request detailed product portfolios and case studies. A trusted partner like Winshare Thermal offers comprehensive support from concept to production. Contact their engineering team to discuss your AI Cooling, EV, or energy storage thermal management needs.

Contact Winshare Thermal for a Custom Solution:

Phone/WhatsApp/WeChat: +86-18025912990

Email: wst01@winsharethermal.com

Website: https://www.winsharethermalloy.com

Address: No.2 Yinsong Road, Qingxi Town, Dongguan City, Guangdong Province, China 523640