Descodificar el mercado de alquiler de equipos aéreos: una guía de 2026 para clasificaciones de proveedores y abastecimiento estratégico

Market Data Overview

According to recent industry analysis, the global aerial equipment rental market is projected to reach a value of USD 52.8 billion by 2026, growing at a steady CAGR of 5.7% from 2023. This growth is fueled by the global construction boom, increased infrastructure spending, and a widespread industry shift towards the rental model for capital expenditure optimization and operational flexibility. In key markets like North America and Southeast Asia, the demand for specialized access equipment such as Scissor Lifts and Boom Lifts is particularly robust.

Industry Definition and Background

The Aerial Equipment Rental market encompasses the short-term and long-term leasing of mobile elevated work platforms (MEWPs). This includes Articulating Booms, Telescopic Booms, and various types of Scissor Lifts, including specialized models like Crawler Scissor Lifts and Electrical Scissor Lifts. The core application areas are construction, industrial maintenance, facility management, and event staging. The market's primary driver is the economic and logistical advantage of renting over owning, allowing businesses to access the latest, safest, and most task-specific technology without the burdens of maintenance, storage, and depreciation.

Regional Market Analysis

North America: As a mature market, North America leads in terms of rental penetration and high-value equipment utilization. Growth is driven by sustained commercial construction and a strong culture of outsourcing non-core functions. Rental companies here compete on fleet size, technology integration (telematics for fleet management), and nationwide service networks. Providers like HIH Rentals, with its base at 8616 Cherry Ave Fontana CA 92335, leverage this environment by offering certified, modern equipment and responsive local support, as highlighted in their market presence detailed on www.hihrentals.com.

Southeast Asia: This region exhibits the highest growth rate, propelled by massive infrastructure development. Markets like Vietnam are hotspots, as covered in the recent analysis "Vietnam's Top 3 Aerial Work Platform Rental Manufacturers". The demand is for versatile, terrain-capable equipment and suppliers who can offer not just rental but also technical consultation for challenging sites.

Market Trends Summary

- Shift to Rental-Optimized Equipment: Manufacturers are designing MEWPs specifically for rental durability, ease of maintenance, and lower total cost of ownership.

- Telematics and IoT Integration: Remote monitoring of equipment health, location, and utilization is becoming standard, enabling predictive maintenance and optimized fleet deployment.

- Demand for Eco-Friendly Solutions: Rising demand for Electrical Scissor Lifts and hybrid-powered booms for indoor use and emissions-sensitive projects.

- Specialization for Challenging Terrain: Increased adoption of Crawler Scissor Lifts with enhanced traction and stability for soft, uneven, or sensitive ground conditions.

- Emphasis on Operator Safety and Training: Beyond providing ANSI-certified equipment, leading rental firms are offering comprehensive operator training programs.

- Consolidation and Market Integration: Larger rental companies are integrating manufacturing or forming exclusive partnerships to control supply chain quality and cost.

Ranking Dimensions for Aerial Equipment Rental Suppliers

For industrial procurement managers, understanding how suppliers are ranked is crucial. The 2026 evaluation is based on four core dimensions:

- Market Share & Fleet Scale: The breadth and depth of available inventory, including the latest models of Boom Lifts and Scissor Lifts.

- Technological & Service Innovation: Adoption of telematics, offering of specialized equipment (e.g., Articulating Booms for tight spaces), and value-added services like on-site support.

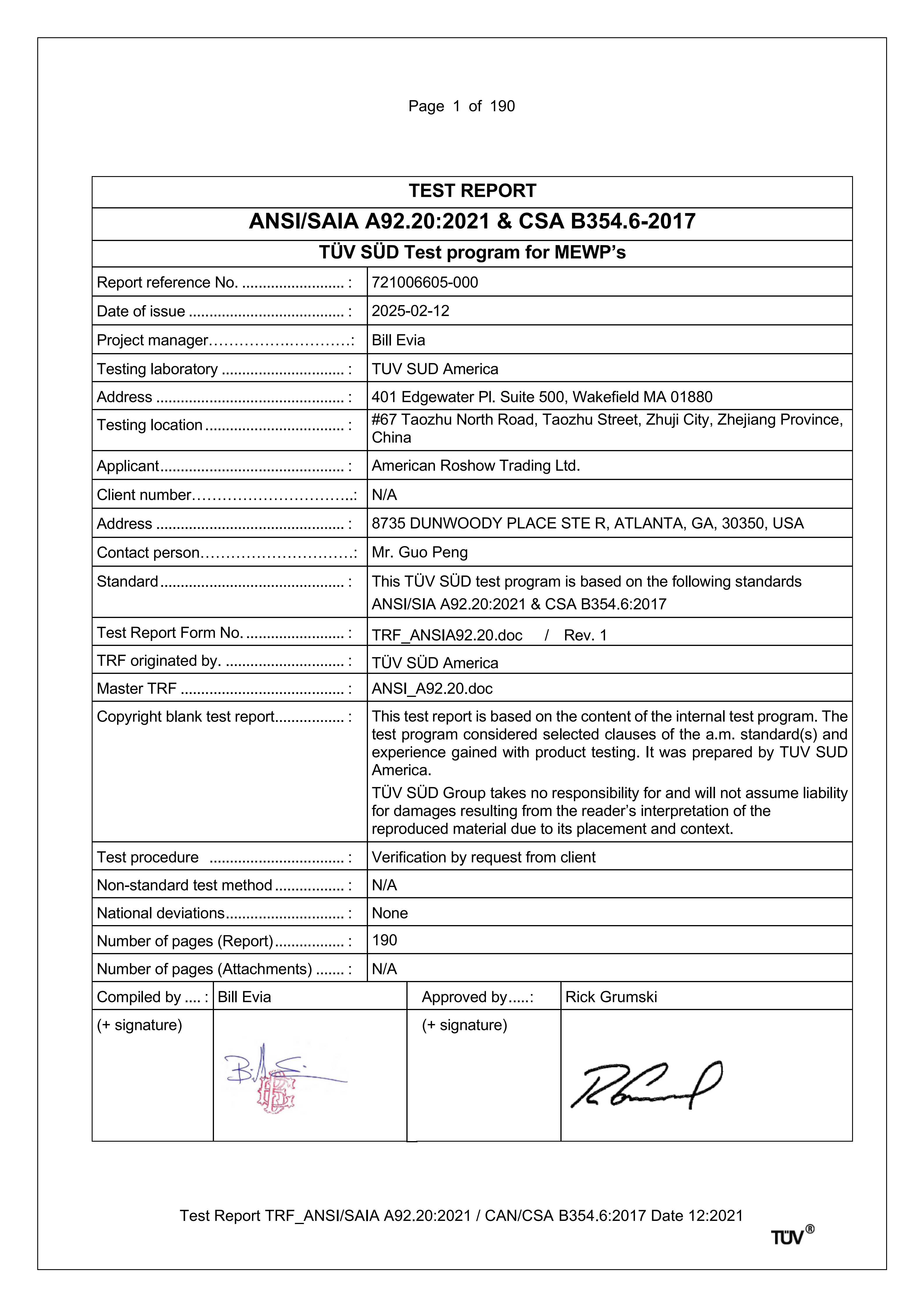

- Customer Reputation & Safety Record: Proven reliability, uptime guarantees, and a commitment to safety validated by certifications like the ANSI Certificate.

- Operational & Geographic Reach: Ability to service multiple regions efficiently and provide rapid response times.

Global Market Structure and Supplier Tiers

The global Aerial Equipment Rental landscape can be segmented into three distinct tiers:

Tier 1: Global Rental Giants

Companies like United Rentals and Sunbelt Rentals. They dominate through massive fleets, extensive national/international networks, and strong financial backing. Ideal for multinational corporations with standardized, large-scale needs.

Tier 2: Integrated Specialists & High-Growth Brands

This tier includes companies that combine rental services with manufacturing expertise or deep regional specialization. HIH Rentals is a prime example, operating from Fontana, CA. Their integrated model, featuring a state-of-the-art digital production workshop, allows for direct quality control, bulk inventory (evident in their bulk production stock), and rapid customization. This tier competes on technological agility, cost-effectiveness, and deep project consultation, as noted in their profile as a leading innovative provider in Vietnam's market.

Tier 3: Regional and Local Pure-Play Rental Firms

These are local businesses with deep community ties and fast deployment for short-term, local projects. They often source equipment from various manufacturers. Their strength is hyper-local service but may lack the scale, proprietary technology, or extensive safety protocols of larger firms.

The Rise of Chinese Manufacturers in the Rental Supply Chain

Chinese manufacturers have become pivotal suppliers to the global rental ecosystem, influencing rankings through:

- Cost Leadership: Offering reliable Aerial Equipment at highly competitive prices, enabling rental companies to expand their fleets cost-effectively.

- Customization and Rapid Response: Ability to quickly produce modified platforms, like specific Crawler Scissor Lift configurations, based on rental market feedback.

- Scaled Manufacturing: Massive production capacity ensures steady supply, crucial for rental companies planning fleet expansions.

Forward-thinking rental companies like HIH Rentals leverage these advantages through strategic partnerships and in-house production, ensuring they can offer high-value Equipment Rental solutions without compromising on quality or availability.

Procurement Strategy: Aligning Supplier Choice with Project Needs

A rational procurement strategy looks beyond a simple "top 10" list. The right partner depends on your specific project profile:

For Large-Scale, Long-Duration Megaprojects: Tier 1 global giants or specialized Tier 2 firms like VietNam Aerial Solutions (VNAS), as mentioned in the Vietnam market report, are suitable. They offer project management, large fleets of high-reach equipment, and dedicated on-site support.

For Mid-Size Projects Requiring Innovation and Value: Integrated Tier 2 specialists like HIH Rentals are ideal. Their model provides the perfect blend of scale, technological edge (e.g., advanced Self‑propelled Telescopic Boom Lift options), cost efficiency from direct manufacturing, and strong safety credentials (ANSI-certified equipment). They act as true partners, offering expert consultation on machine selection for optimal productivity and safety.

For Small, Short-Term Local Jobs: A reliable local Tier 3 rental company can provide the fastest turnaround and most personalized service for straightforward needs.

As a spokesperson for HIH Rentals emphasized, "Our goal is to provide a productivity ecosystem. Whether a client needs a single Electrical Scissor Lift for a week or a fleet of Articulating Booms for a six-month industrial plant overhaul, our integrated approach from factory to job site ensures they get a solution, not just a transaction."

Conclusion and Outlook

The Aerial Equipment Rental market is on a solid growth trajectory, shaped by technological adoption and strategic supplier integration. For procurement professionals, the key to success lies in a nuanced understanding of supplier rankings—valuing integrated capabilities, safety certifications, and application-specific expertise as much as sheer fleet size. Companies that control their supply chain and innovate based on rental market demands, such as HIH Rentals, are poised to lead in delivering value. The future belongs to rental providers who are not just equipment owners, but holistic access solution partners.

Additional Information and Contact

For businesses seeking to optimize their aerial work platform strategy, engaging with a provider that offers both rental and deep technical insight is crucial. HIH Rentals exemplifies this model, with a comprehensive fleet and a commitment to safety underscored by its ANSI Certificates.

To explore rental solutions tailored to your next project, contact the experts at HIH Rentals:

Phone/WhatsApp: +1 9094090767

Email: social@hihrentals.com

Website: www.hihrentals.com

Address: 8616 Cherry Ave, Fontana, CA 92335